Legal help that’s

free for you.

Just a phone call away.

What do you have to lose?

Employee background checks are susceptible to inaccuracies. Both individuals handling public and private data and computer systems can make errors. Here are some of the most frequent causes of inaccurate information appearing in your report:

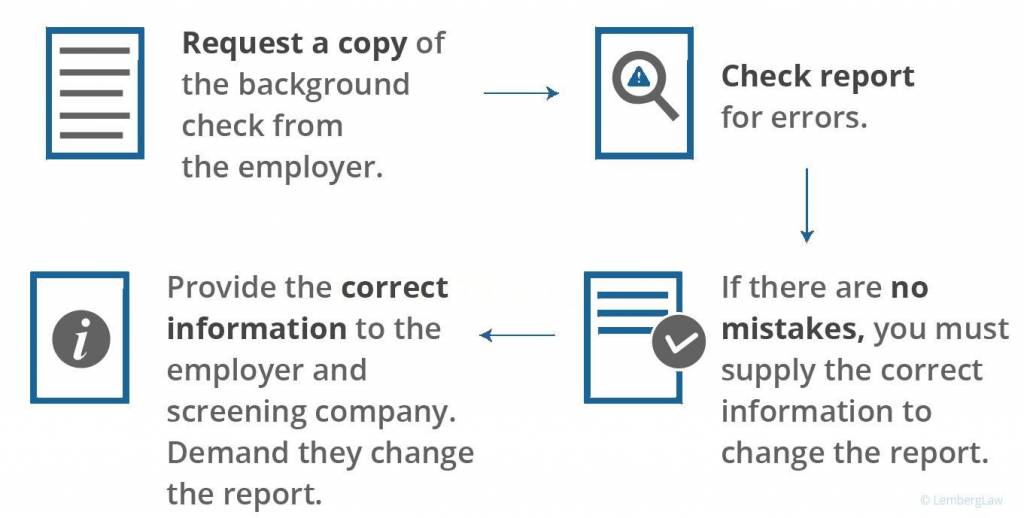

First, request a copy of the report from your employer, who is obligated to provide it. Often, employers hire consumer screening companies to compile these reports, in which case they must provide you with the company’s name and contact information.

Second, carefully review the report for errors. Some inaccuracies may result from clerical errors, such as number mix-ups or misinterpreted handwriting, confusion due to similar names, incomplete or incorrect information provided by you, outdated credit data, or identity theft. If the mistake was made by the employer or screening agency, they must promptly rectify it.

Third, if the error did not originate from the employer or screening agency, you must obtain the correct information from the source. The employer may have requested various reports, such as credit, criminal, or educational records. For instance, you may need to contact the credit reporting agency to correct erroneous credit report information or reach out to a law enforcement agency or court to rectify an inaccurate criminal report.

Fourth, provide this corrected information to both your employer and the screening company. Request that they update the report and furnish you with a copy.

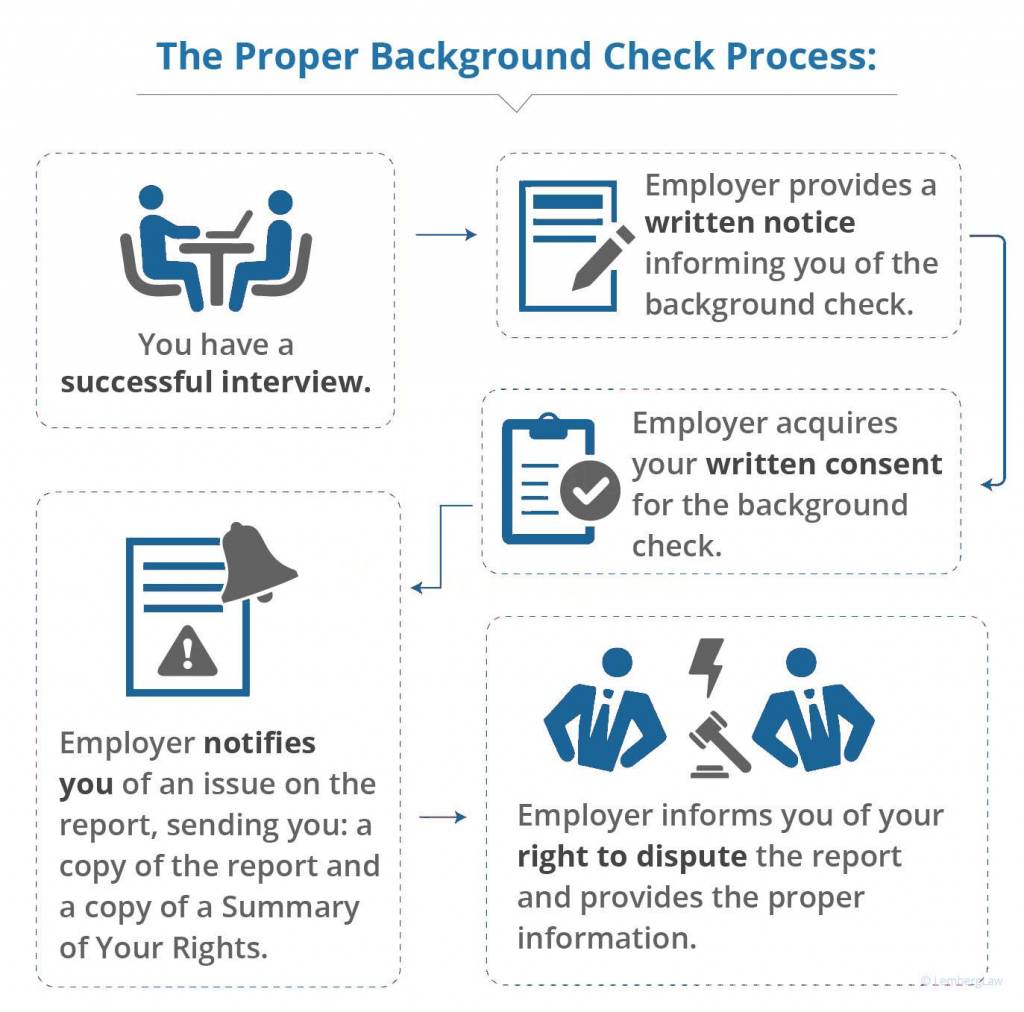

Additionally, you need to determine whether the employer adhered to the procedures outlined in the Fair Credit Reporting Act (FCRA). Ask yourself the following:

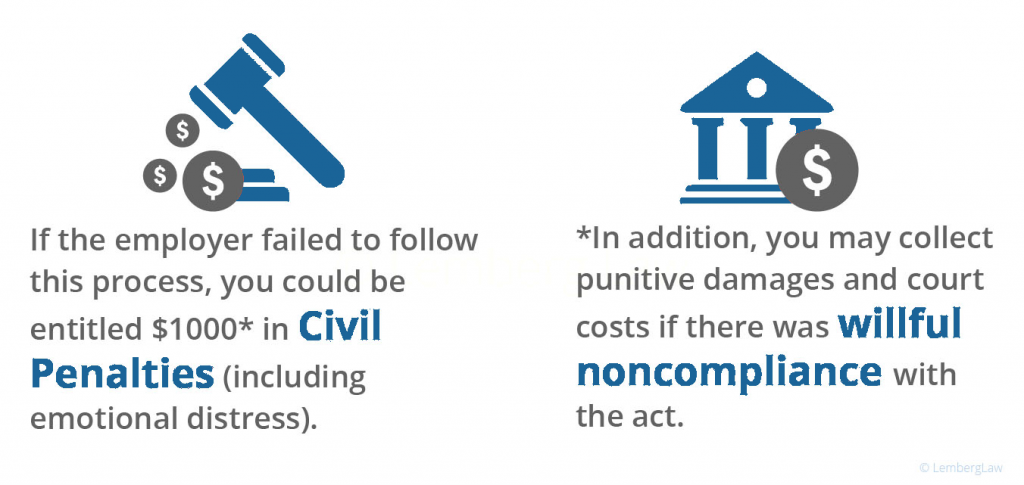

If the employer failed to adhere to these procedural requirements, you may have grounds for legal action. It is advisable to seek counsel from an experienced employment attorney, as you may be entitled to civil penalties up to $1,000 and actual damages, which can include emotional distress. In cases of “willful noncompliance” with the Act, punitive damages, along with attorneys’ fees and costs, may also be recoverable.